Table of Contents (click to expand)

The economic activity of a nation is tracked by monitoring the cyclical fluctuations experienced by various indicators, the prominent one being real GDP. These cycles are not recurrent, but not periodic, and help an economy decide policy interventions based on where it is in the cycle.

A teacher teaching children in a school or a software engineer working for a company qualifies as an economic activity, and any other legal activity undertaken by an individual upon the completion of which they receive remuneration or a fee is called an economic activity. Note, although there is an exchange of money for drugs in return, this is not considered an economic activity, as it is an illegal activity.

Income earned through such an exchange will never be accounted for when a country calculates their GDP, as the earner will definitely not show it as their income!

Economic activity worldwide is primarily measured by a framework set by the International Labor Organization (ILO). Countries have adopted statistical systems worldwide based on the industrial activity classification provided by the ILO. The classification tries to represent the aggregate activity within an economy as accurately as possible; hence it’s updated periodically.

A country must track their economic activity, as these activities generate income or GDP for a country. Classifying these activities provides insight into which activities are broadly contributing to a nation’s income. Awareness of this level of information helps policymakers design interventions that shape the country’s development.

Now, this economic activity is bound to experience fluctuations for multiple reasons, including shocks caused by natural disasters or economic recessions and booms due to technical innovation or the discovery of natural resources. Therefore, it is equally essential that a country tracks its activities’ movements over time. This is done through business cycles.

Recommended Video for you:

What Do Business Cycles Look Like?

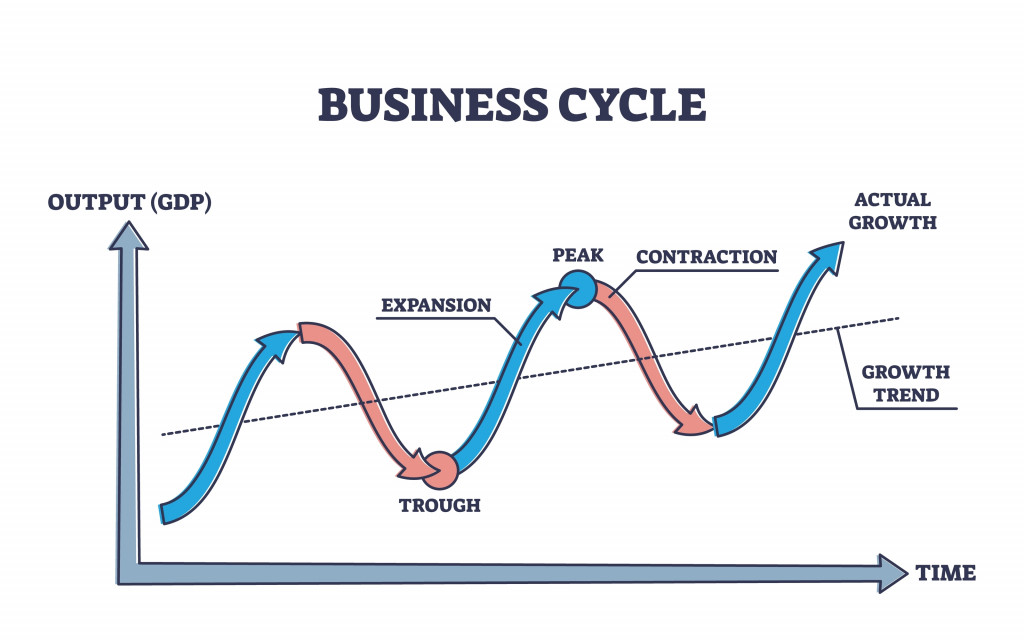

The cyclical fluctuations of upswings and downswings that an economy experiences due to fluctuations in its real GDP, employment, income and sales is called a business cycle.

The upper tipping point of the curve is known as the peak. This represents that point for an economy when the GDP peaks. The economy cannot stay here for an extended period, as it is unsustainable. The peak is where aggregate demand in the economy usually surpasses aggregate supply, resulting in prices rising (inflation), as the current supply cannot cater to the existing demand.

On the flip side, it is also the point where unemployment is extremely low, as suppliers are hiring as much labor as possible to cater to this demand. This situation cannot persist; it is a bubble. This is why it is immediately followed by a recession. Mind you, peaks can also be the result of a sudden technical invention, like the steam engine, which kept the economy at a peak from 1780 to 1830.

Following such a peak, an economy usually cools off. A recession is generally defined as the period between a peak and a trough. Although technically a recession occurs when real GDP falls for two subsequent quarters, real GDP may not be the sole indicator for a recession.

Again, these are not cyclical; one cannot accurately predict them, as events can also be random. For instance, the COVID-19 pandemic caused an unprecedented worldwide recession.

Expansion is usually said to be the normal state of an economy. An economy is led in this direction by the government and a country’s central bank through policy intervention via taxes and interest rates, as required.

Tracking The Cycle: When Is It Called A Recession?

Economists worldwide have struggled to accurately predict when a recession will commence and end. In the US, it is the role of the National Bureau of Economic Research (NBER) to identify the dates of the four points in a business cycle—peak, contraction, trough, expansion.

Since the Committee’s formation in 1979, the average lags in the announcement of a recession’s start and end dates have been eight months for peaks and 15 months for troughs.

The exact duration an economy will take from a peak to a trough and vice-versa varies across cycles. Usually, the dates of attaining each point for an economy is declared by the NBER for the US economy with an approximate lag between 4 and 21 months.

For the NBER, the severity of a recession takes three criteria into account—depth, diffusion and duration. Similarly, the strength of an expansion falls under another set of three criteria—pronounced, pervasive and persistent. Each of these criteria has its respective indicators.

The depth of any period is measured by how these criteria are individually affected. Sometimes, the effect of a criterion could also overpower the rest and lead to a recession or an expansion. However, the NBER broadly looks at real GDP, real income, employment, industrial production and wholesale-retail sales. There is no fixed rule for the information that the Committee staunchly uses for decision-making.

According to the NBER, the most recent peak occurred in February 2020. The most recent trough occurred in April 2020. Between February and April, the US economy did experience a recession. These 2 months of recession are the shortest on record. The pervasiveness of a recession will only be confirmed if it is corroborated with similar data from other indicators above.

Subjectivity In Cycles

Not only is the point of occurrence subjective, but the idea of a business cycle is also driven by contrasting ideas from various schools of economic thought.

For instance, economist Joseph Schumpeter does not entirely believe that the cycle results from fluctuations in demand and supply for capitalist economies. While an economy would tend to reach its optimal point where supply catches up to demand, he still believes that the propeller for change was innovation.

Khan Academy has also tracked how emotions play out during a business cycle!

Notice the emotional high during the period of expansion that peaks at euphoria. Contrast these emotions with the slow fall into a recession that ends in depression. The emotional driver from the depression onwards lies mainly with the policies initiated by the government during this period. This is also why we see hope as the starting point for the next cycle!