Table of Contents (click to expand)

When households collectively save more, it can have a disastrous impact on the economy. Learn how increased saving at an individual level can harm overall economic growth and why government intervention becomes crucial in stimulating demand.

The savings rate of most economies rises on the pretext that the economy’s GDP also rises each year. This behavior at a micro level translates to increasing savings of households as the result of increasing incomes.

However, a sudden increase in savings by every household in the economy would prove detrimental to the economy at a collective level. While the adage ‘Save more, Buy less’ is true, when collectively followed, it can shrink the size of the economic pie.

Recommended Video for you:

What Is The Paradox Of Thrift?

Assuming everyone’s income in the economy is unchanged, if every household decides to cut down on their consumption and increase saving at the same time, it will have a disastrous effect on the economy. As you can see, it is paradoxical, because while increased saving at an individual level is good for the household, it can have a destructive impact on the overall economy.

John Maynard Keynes, a renowned British economist, popularized the phenomenon of the paradox of thrift. The phenomenon occurs only during economic recessions, which leads to a drastic fall in the aggregate demand generated in an economy and has a negative impact on economic growth.

What Causes This Disaster?

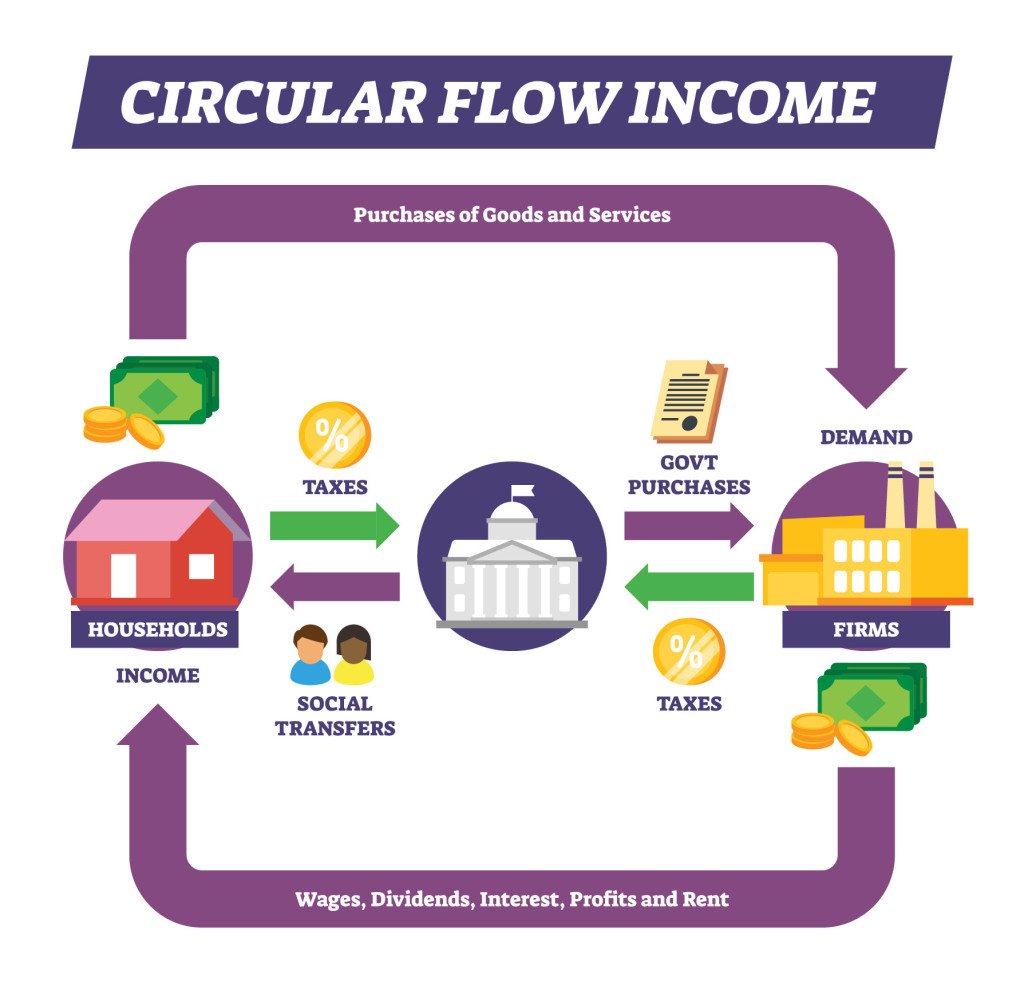

The various activities conducted in the economy are circular. This means that one’s decision to consume yields income for another. Similarly, one’s decision to save becomes a source of borrowing and investing for another. For example, when you decide to buy a pair of shoes, it is recorded as a consumption decision, and the same pair is registered as income by the shopkeeper who sells you the shoes. Similarly, when you decide to save money in any financial institution, this amount becomes a part of their lending corpus.

Therefore, the activities of any economy are closely interconnected and thus circular. Assuming that incomes remain unchanged, a unanimous decision to increase household savings will have a ripple effect. Since their overall consumption expenditure would decline, the planned decisions made by businesses to build up their sales would take a hit and increase their inventory.

This would pause all further manufacturing and service-related decisions, as demand would be suddenly reduced.

Businesses would take a step back, as this decision affects their incomes. They now have to find a way to get rid of their stocked inventory, because despite any price change, individuals will not alter their decision to save more.

Again, this impact would hit perishable businesses more gravely than others, as their stock bears an additional risk of spoilage. If the household’s decision to save continues, businesses will not invest in newer prospects, as the economy lacks demand. New investments decline if there is no sign of economic demand.

Eventually, businesses would have to pause hiring or lay off employees if the situation remains bleak for an extended period. This would decline household incomes and cause a dip in the economy’s savings. The economy, at this point, will head into a recession.

It is often rare, but not impossible, to see a sudden rise in the savings rate without a commensurate rise in income. Governments usually jump in to avoid further damage if the economy is heading down that path. They end up making expenditures to boost incomes in the economy to aid consumption demand.

Consumption expenditure is a critical component in the calculation of the GDP of any economy. It is this decision that primarily influences investment decisions by businesses. Otherwise, governments have to levy additional taxes and actively prevent the economy from going into a slump.

When Does This Play Out In The Economy?

This never happens on any regular day in the economy. It is never a unanimous decision, unless the economy is foreseeing a bleak future, such as a recession or any other upcoming wars or natural disasters. Again, this is rare, but not impossible. Three major events that have led to a rise in the saving rate without a simultaneous rise in incomes are The Great Recession (1929), the 2008 housing crisis, and the Covid-19 pandemic.

During recessions, individuals need to play it safe, so a rising savings rate is also the correct response when the economy is heading into a recession. There is fear of job losses, pay cuts and price rises. During such periods, governments and central banks try to slash interest rates and increase unemployment benefits to spur economic demand.

Keynes advocated that if both these measures do not stimulate demand in the economy, governments should borrow and spend more money in the economy to build demand. This is primarily to boost investor confidence and consumer confidence in the economy.

Governments play a critical role in raising demand in the economy. Businesses won’t simply start lending money if they do not see worthwhile demand for their goods in the economy.