Table of Contents (click to expand)

A cash cow is a product that produces steady ‘milk’ (profit) long after the initial cost of investment has been recovered! This jargon has long been used in the Boston Consulting Group (BCG) matrix – a simple tool that helps companies decide which products they should keep, which they should let go, and which they should invest in further.

Cows are generally generous and undemanding animals. If you own a cow, what it brings to your home is priceless—fresh, clean and raw milk for a long time! It asks only for shelter and some fodder in return. That being said, what does a cow have to do with cash?

If you own a business or are in charge of managing one that offers a range of products, you often need to conduct a portfolio analysis to check how well each of the products is doing. You might have products that are flourishing, as well as products that are not doing very well, but have the potential to do so, and those that are suffering significant losses. A cash cow is a product that produces steady ‘milk’ (profit) long after the initial cost of investment has been recovered!

This jargon has long been used in the Boston Consulting Group (BCG) matrix – a simple tool that helps companies decide which products they should keep, which they should let go, and which they should invest in further. In order to understand cash cows and their place in the BCG matrix, we first need to look at the terms market share and market growth.

Recommended Video for you:

Market Share And Market Growth

Market share is the percentage of the total market being serviced by the company. Suppose that your company manufactures soaps. If consumers buy a total of 100 bars of soaps, 30 of which are from your company, we can conclude that your company holds a 30% market share.

Simply put, market share is your share in the market. It can be measured either in terms of your share of product units sold or your share of revenue. Needless to say, a higher market share is a good thing for your business. A pure monopoly exists when one company holds a 100% market share!

Market growth, on the other hand, is used as a measure of the attractiveness of a given market. A growing market is basically a market experiencing increasing demand, which makes it easier for businesses to increase their profits, even if their market share remains unchanged. A low-growth market, however, leads to cutthroat competition between the companies. It may get harder to retain your market share without aggressive discounting.

For example, consider the following situation in a low-growth market. Suppose that the demand for soap is 100 and your share is 30. Since the demand rarely increases, you must fiercely compete with other companies to increase your share and consequently grow your business. In a high-growth market, on the other hand, your business can be increased in conjunction with the growing market. When the total market demand grows to 150, your sales will also grow to 45, simply by maintaining your market share at 30%.

Boston Consulting Group (BCG) Matrix

The BCG matrix is a tool to evaluate the products of a company, and thereby help to decide where the company’s resources can best be allocated to maximize profits in the future. It divides products into four categories based on their market share and market growth.

1. Stars – Stars are the strong ones. These generate a huge amount of cash due to their large market share, but also require large investments to sustain their high growth rate. If they’re able to maintain their market share, they will eventually become cash cows once market growth slows down. The iPhone, for example, is Apple’s star product.

2. Cash Cows – Cash cows are leaders in a more mature market. These are successful products that enjoy a large market share in a well-established market. Since a cash cow demonstrates a return on assets greater than the market growth rate, it generates more cash than it consumes. These products should be ‘milked’ by extracting the profits and continuously managing them so that they keep generating strong cash flows, which can be further used to fuel stars.

Apple’s MacBook has a consistent market share and steady revenue, making it a cash cow for the company.

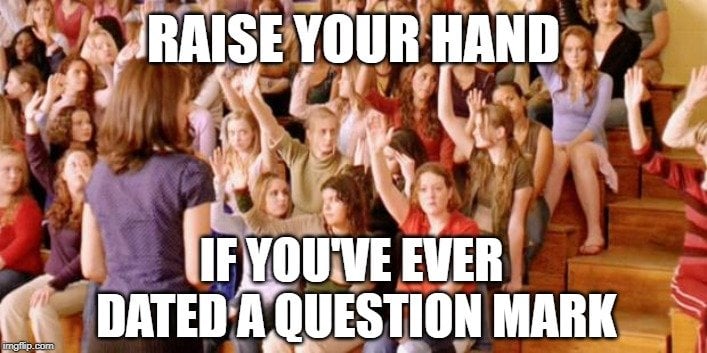

3. Question Marks – Question marks grow rapidly, and thus consume a large amount of cash, but don’t generate as much cash due to their low market share. As their name suggests, they are very tricky and leave us wondering what future course they might take. A question mark has the potential to lead the market and gain market share to become a star (and eventually a cash cow when market growth slows), but if it fails to succeed in the market, it will become a dog when market growth declines. These products need to be constantly examined and reconsidered to decide whether they are worth the investment they demand.

Apple TV certainly belongs in this category, as it has promising room for growth, but also calls for huge investment and innovation in order to make this product a significant contributor to Apple’s revenues.

4. Dogs – Dogs are the low market share and low-growth products that neither generate nor consume large amounts of cash; they are basically going nowhere. They are cash traps because the money already invested in them is being tied up in a business that has low or no potential.

After assigning each of the company’s products to one of the above categories, depending on their market share and the growth of the market in which they are operating, the company may decide on a further course. It may decide to build, hold, harvest or divest. This means that the company may decide to make further investments (e.g., to maintain a star, or to turn question marks into stars), maintain the status quo, reduce investments (and enjoy the positive cash flow from a cash cow), or get rid of products (e.g., dogs) and instead use that capital towards investments in stars and question marks.

The BCG Matrix has its own limitations, since it’s a very simple tool using only two dimensions—market share and market growth. Even so, it remains a useful tool in portfolio analysis.

A company should have at least one cash cow that can generate steady revenue, be used to fuel stars, and to develop stars from question marks. Cash cows are, after all, just like best friends—steady, strong and dependable!