Table of Contents (click to expand)

The poison pill strategy is a deterrent that safeguards a company from hostile takeovers by making the deal less lucrative for those acquiring the company.

Wars are as much a thing of corporate board rooms as they are of battlefields. And some the most spectacular corporate wars do not involve guns, grenades or the wasteful loss of resource. They are steeped in strategy and mind games, while (almost) never spilling a drop of blood.

What options does a company have to ward off hostile attempts, despite being the weaker side? Is figurative self-harm a way out of a takeover? What is the poison pill strategy?

Let’s break it down.

Recommended Video for you:

A Crash Course In Share Markets

The share market relies heavily on demand-supply economics. An entity whose supply exceeds demand will sell for cheap.

Conversely, something that is not readily available, but in high demand, will always command a premium. When an entrepreneur is looking to raise money for his business, he has a few choices.

Private Funding

The first is a bank loan. However, loans must be repaid, along with interest, which is the opportunity cost incurred by the banker. Another option is to take money from venture capitalists; a fancy name for rich people exchanging their money for prospective profits. The money is exchanged against part ownership of the company in bits and pieces, called shares or equity. The cumulative of these shares, called stake, is expressed as a percentage of total ownership.

Public Funding

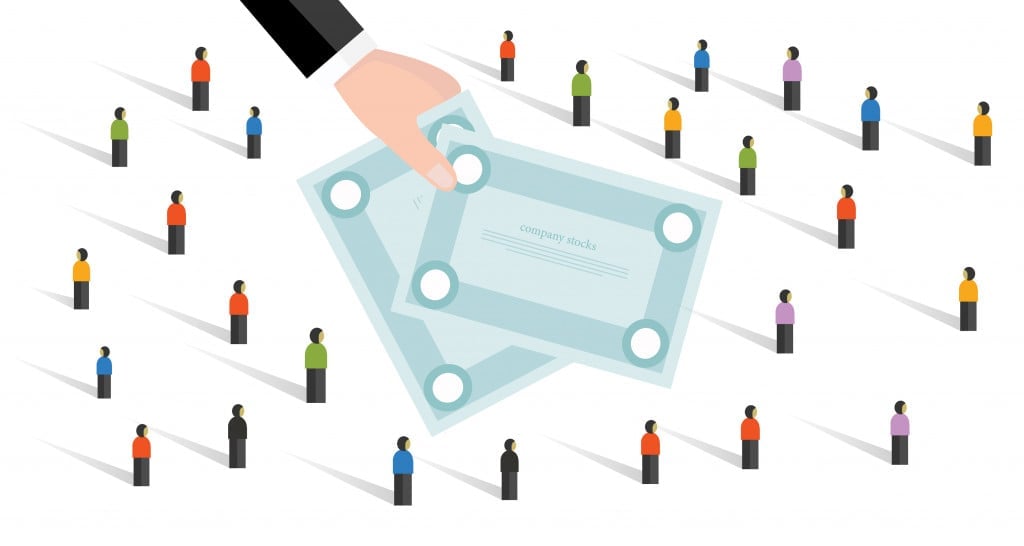

When the mode of raising funds moves from a less concentrated pool of lenders to a wider audience, the company is said to be publicly traded. The salient feature of this form of raising funds is that people lend money based on their capacity. The money is raised from the sheer volume of shares sold to a wider audience, rather than a big stake sold to a smaller group of interested individuals. A company may either sell some or all of its shares to be traded as a public company.

Since shareholders are technically partial owners, they are entitled to influencing decisions that are made by the company. However, this is not practical in a publicly traded company. Thus, the cumulative interest of all shareholders is represented and safeguarded by a group of individuals, also called the board.

What Is A Hostile Takeover?

A hostile takeover happens when a single individual/entity buys a significant chunk of the shares against the management’s wishes. However, there is little they can do to avoid this, as the shares would have been bought legally from the public market where they are traded. Is there a way out of such a mess?

Enter Shareholder’s rights plan, more commonly known as the Poison Pill strategy.

Poison Pill Strategy

The poison pill strategy is not new. However, it recently shot to fame after Elon Musk (CEO, Tesla & SpaceX) acquired a huge amount of shares of the microblogging platform Twitter, later offering to buy it outright, against the board’s wishes.

The shareholder’s rights plan, or the poison pill strategy, is a clause built into the organization’s charter, deterring hostile takeovers by diluting the acquirer’s percentage stake in the company. There is a threshold value of the percentage of shares owned by a single person. When that threshold value is crossed, the shareholder’s rights plan, or the poison pill, as we know it, gets invoked.

How Does It Work?

To do this, the target organization, in this case Twitter, releases more of its shares in the open market to be bought at less than its current market value. These shares are usually created by dissolving some portion of the stake held by the management and board of the company.

However, this offer is only available to shareholders other than the acquirer (in this case, Elon Musk).

This has a few effects. The foremost is the dilution of the percentage stake of the target company held by the acquirer. This happens because of the increase in the number of shares being traded in the open market, without any increase in the acquirer’s stake.

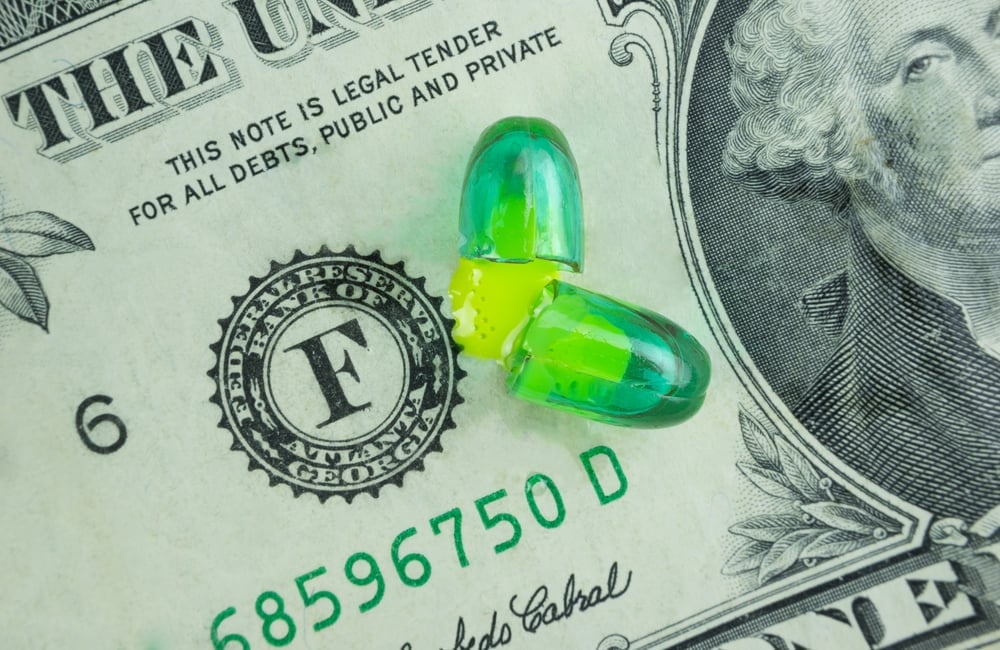

At the same time, the discounted share price means that there is more supply than demand, further risking devaluation or figurative self-harm for the company. This strategy is also known as the “flip-in” poison pill, wherein the organization makes it more expensive for itself to get taken over by the acquirer.

There exists another strategy, known as the “flip over” poison pill. This allows the shareholders of the target company to acquire a heavily discounted stake in the acquirer’s company. This causes value dilution in the acquirer’s firm, making it less conducive for them to complete their takeover bid.

What Options Does The Acquirer Have?

Triggering the poison pill is not the ultimate solution to a hostile takeover – it is merely a delay mechanism. It gives the board more time to think about the future of the company, and forces the acquirer to generate a more lucrative offer. Depending on the acquirer’s inclinations, he may choose to walk away from the deal, or make a more profitable offer to the board. At the same time, the board can either decide to reach common ground with the acquirer, or change their governance strategy.

Another, more unpleasant way of dealing with the poison pill is bypassing any negotiations with the board, and appealing directly to the open market shareholders. Known as a tender offer, the acquirer appeals via mass media, such as newspapers, to these stakeholders to relinquish their shares in exchange for a premium over the market rate. But why would shareholders want to sell their holdings to the acquirer?

Well, share markets are governed by various sentiments, not just profit. Many shareholders would be willing to exit their positions because they’re not happy with the way the company is being managed. A tender offer, though not all that frequent, is a profitable way to exit one’s risky position in the company.

What Happens In Friendly Takeovers?

The poison pill is a policy built into any organization’s charter and is triggered when a given threshold is crossed. However, what if it is desirable to get taken over? In such cases, the decision of invoking the shareholder’s rights plan is put to vote with the members of the board.

If it passes, the poison pill ceases to be applicable, or gets “rescinded”, in managerial parlance.

Ending Note

At the time of writing this article, Mr. Musk has managed to push through his offer of acquiring the microblogging platform Twitter, for a sum of USD 44 billion. This happened after the board ceded to Elon’s offer of USD 54.2 per share. This was a considerable step up from the original cost of the shares before Elon Musk triggered the poison pill strategy. However, the final acquisition is far from complete due to Twitter’s business practices that are unacceptable to Elon Musk, with speculators going so far to say that he may withdraw the offer completely.

References (click to expand)

- (2007) Hostile Takeovers in India: New Prospects, Challenges and .... The Social Science Research Network

- B.W.A. Möhlmann - Hostile Takeovers: The Long Term Effect On Shareholder Value Of Acquiring Companies - CiteSeerX

- (2012) Defensive strategies against hostile takeovers. The analysis of .... jois.eu