Table of Contents (click to expand)

Learn why countries can’t peg their currencies to commodities like gold. Discover the flexibility of floating exchange rates and how they help navigate economic challenges. Explore the impact of even minor rate fluctuations in this fascinating journey through monetary history.

No country on Earth today is entirely self-sufficient. Even if it can produce all the required goods by itself, it may not always be able to do that at the most efficient price. This is why countries trade with one another, despite being able to produce the same goods internally, due to differences in price and quality in competitive trading countries.

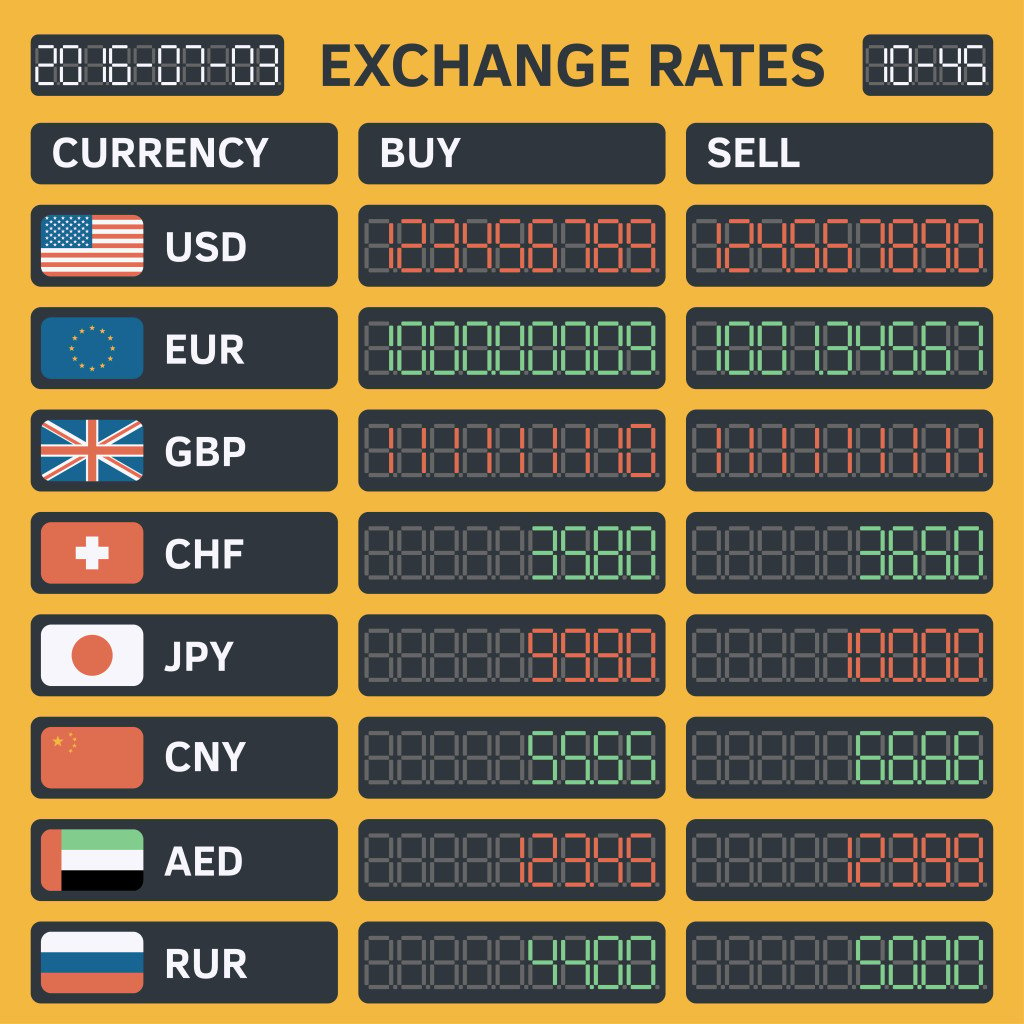

In international trade, apart from the price and quality of a given good, the exchange rate of the currencies involved also play a pivotal role. For instance, if a citizen of the UK wants to purchase 10,000 pieces of chocolate, which cost $1 each, they would need to pay $10,000. For making this payment to the supplier located in the US, dollars are required, for which the British person will have to exchange their pounds. If the exchange rate is $1=1£, they could exchange £10,000 and receive $10,000.

However, exchange rates are almost never 1:1, which means that 1 unit of currency does not trade for an equivalent unit of another currency.

In the case of transitioning pounds sterling to USD, the exchange rate is 1$=0.82£.

For making a payment of $10,000, one would have to exchange only £8,225. Notice the impact of a difference of 18 pennies on the total price when the settlement is for a significant amount.

Therefore, even minor fluctuations have a significant impact. Trade in real life is settled in the billions of dollars; even slight changes to currency exchange rates can make or break a deal, as it will cause substantial gains and losses for the parties involved.

For two countries to trade, borrow, lend or any other activity that involves payment settlement, it is imperative to have stability in their exchange rates. If a minute change, as above, can cause a savings of £1,775 (10,000-8225), you can only imagine the drastic impact of significant fluctuations.

This article examines the various efforts by countries to stabilize their currencies and look at recent developments that countries are utilizing to overcome the fluctuation problem.

Recommended Video for you:

Why Can’t Countries Peg Their Currency To A Commodity?

Gold is the first commodity that comes to mind with a question like this. In the late 19th century and until the early 21st century, countries pegged the value of their domestic currency directly or indirectly to gold. This resulted in a fixed exchange rate. For e.g., if $1=35 ounces of gold, 35 ounces of gold could be exchanged for $1.

This mechanism is known as pegging, wherein the value of one currency is fixed in terms of another currency/commodity. All currencies, therefore, expressed their own value in relation to the weight of gold.

To maintain a fixed exchange rate, countries held gold reserves that were equivalent to the amount of money in circulation. If the government wanted to increase expenditure, it had to store an equal amount of gold in its reserves.

This arrangement worked well until the early 21st century. It had to be abandoned due to increased government spending required during wars. The value of the domestic currency in relation to gold could only be maintained by limiting the money supply.

The currency’s value will fall if an excess money supply is released in the economy. This was the case during the war years. This increasing government expenditure increased the money supply in the economy, which reduced the value of money in the economy.

Countries had to take corrective steps to maintain this exchange rate. In the above case of excess expenditure, the excess money supply had to be curtailed. This could be done in two ways: reduce expenditure and increase gold reserves. Both of these have severe limitations, as war requires countries to spend money not just on the military, but also on welfare expenses.

Acquiring additional gold was not possible, as it was limited in supply (there is only so much you can mine or borrow!), and countries had to prioritize spending during grave periods.

Any other commodity would also face the same result, as governments must operate flexibly. They need to be able to increase spending when they deem it necessary. If the government does not spend during such periods, the economic activity would slow down and worsen the misery.

How Does The Current International Exchange Rate System Operate?

Most countries today have adopted a floating exchange rate. The exchange rate in this system is determined by demand and supply without government intervention. Some countries have still pegged their currencies to other currencies, such as China and the UAE with the US Dollar. Exchange rate stability is why these countries peg their currency. There are different facets to this decision that extend beyond the scope of this article.

The floating exchange rate system provides countries with flexibility. In times of uncertainty, be it war, pandemics, or financial crises, government intervention is necessary. Governments are expected to incur expenditures to boost demand in the economy. If it holds back, the economy could enter a recession, worsening its state of affairs.

A floating exchange rate system doesn’t guarantee stability, as it is susceptible to sudden demand and supply fluctuations. Nonetheless, it comes with certain advantages. The flexibility with which countries can increase or decrease their money supply to support their economies is primarily why floating exchange rates remain such a popular choice!

Therefore, over time, most countries have prioritized flexibility over a fixed exchange rate system in order to circumvent any restrictions over internal spending. Stability is equally desired, so long as it does not restrict a country’s power to make internal expenditure decisions.